IR35 was introduced in the 1999 Budget to counter concerns about the use of private service companies.

The now-infamous Inland Revenue Press Release 35 announced that the Government would crack down on the hiring of individuals through their own service companies as a means of evading tax.

It was originally HMRC’s responsibility to decide if an employment practice was caught in IR35. But in 2017 a major change was introduced in the public sector. The responsibility of deciding compliance was imposed upon the ultimate client or engager for the service.

The new regime created major challenges for public sector employers, and led to many tribunal cases. AAT lobbied the Government over its concerns.

In spite of this, IR35 rules are to be extended to medium and large private sector organisations from April 2020.

Fred Ltd – simple example

A typical HMRC attack under IR35 would be as follows:

Fred is a full time chef at the hotel, working there daily from 06.00 to 17.00 Monday to Saturday.

Fred bills his work through his personal service company Fred Ltd.

95% of Fred Ltd’s income comes from the hotel.

HMRC would argue that, if Fred did not have the protection of his company (i.e. if he was engaged as an individual by the hotel), then he would be a deemed employee of the hotel:

If HMRC succeed with their argument, then in very general terms, Fred Ltd has to account for PAYE and Class 1 national insurance on the fees that it has rendered to the hotel.

To defeat HMRC’s IR35 argument, Fred has to prove that, if he was engaged as an individual by the hotel, then he would be self-employed. If he can successfully do this, then there would be no IR35 PAYE and no employees’ national insurance liability.

There are five factors that can assist his claim that he is self-employed. These are:

Control

There must be no control or absolutely minimal control over him by the hotel.

No mutuality of obligations

There must be no ongoing and regular obligation for the hotel to have to give him work and Fred Ltd also must have no obligation to accept it. To be self-employed you must be able to show that you can turn work down. Mutuality of obligations has been an important and deciding factor in many cases over the years. To be self-employed, you must win both of these first two points i.e. show there is no control and no mutuality of obligations.

Substitution

Does Fred have the right to provide a substitute to do this work with the hotel (say Alan)?

Does Fred approve, choose and engage the substitute Alan? Has Fred ever used Alan?

If so who bills who? If the substitute is used, then Fred Ltd must still bill the hotel, and Alan duly bills Fred Ltd. The substitute should never bill the ultimate engager.

Insurance

The question of insurances is another important factor.

Does Fred Ltd pay the relevant insurance i.e. public liability insurance?

HMRC will try and dismiss this argument, but it is relevant as employees will not pay this type of insurance.

Self-employment

IR35 does not apply when the hotel engages the individual directly i.e. not through a personal service company.

This will simply be a case of employed v self-employed, and a possible failure to operate PAYE.

IR35 and the private sector

From 6 April 2020, a medium or large-sized engager in the private sector will be responsible for deciding whether their engagements are caught by IR35. The rules will apply to engagements of personal service companies and partnerships.

Note: a Personal Service Company (PSC) engaged by a small business from 6 April 2020 will continue to assess its own IR35 status and be liable for its tax and NIC deductions under the existing IR35 legislation.

If the engager decides the arrangement is caught to IR35 it must deduct IR35 PAYE and NIC Class 1 from the fees rendered to it by the personal service company they engage.

Small business exemption

The legislation applies to medium and large business engagers in the private sector. Small organisations do not have to apply the rules. Accordingly, a Personal Service Company (PSC) engaged by a small business from 6 April 2020 will continue to assess its own IR35 status and be liable for its tax and NIC deductions under the existing IR35 legislation.

To be a large or medium-sized engager, it must meet two of the following conditions:

- Turnover – More than £10.2 million.

- Balance sheet total – More than 5.1 million.

- Number of employees – More than 50.

It should also be noted that for large individual and partnership engagers, only one test is applied – whether turnover exceeds £10.2 million. The balance sheet and employees tests are not applicable to them.

Working through deductions

In our Fred Ltd example, Fred is assumed to be working for large hotel, which decides the engagement is caught to IR35.

The engagement starts after 6 April 2020. Fred Ltd renders a fee to the hotel of £100,000.

The hotel has to deduct PAYE and NIC from Fred Ltd’s £100,000 fees. The hotel puts the £100,000 fees of Fred Ltd through their payroll as if it were employing Fred. It will also cost the hotel employer’s NIC of 13.8% x the fees.

The PAYE and NIC deduction

The hotel gives Fred an HMRC new employee starter questionnaire to complete. The hotel gets Fred’s coding notice etc. The hotel will endeavour to be in a position to know the correct NIC and PAYE to deduct. The hotel will notify Fred that they have decided that IR35 will apply (there is now an appeals procedure for Fred….see later).

The hotel deducts the NIC and PAYE of say £40,000.

Fred Ltd (not Fred) receives the £60,000 net fee.

No corporation tax

Fred Ltd will not effectively pay corporation tax on the £60,000. It is deemed to be Fred’s personal employment income. But remember that the £60,000 is now sitting in the company.

Fred’s income

At the end of the fiscal year, The hotel will give Fred a P60. His accountant will put the appropriate figures on Fred’s own personal self-assessment tax return. Will The hotel have deducted enough tax from it, or will there be further tax to pay by Fred?

It is Fred’s deemed employment income!

The extraction of funds

Fred has a mortgage. He needs to extract the funds tax-free from his company. He can extract the funds as either a tax-free salary, or a tax-free dividend.

Many accountants would prefer to extract the funds as a tax-free salary.

Dividends to minority shareholders (not Fred) are not tax-free in this area

The costs to the hotel

The costs to the hotel are the 13.8% employer’s NIC and also the costs of running it through the payroll. There is also the threat to Fred suing the hotel for employee rights and benefits.

Larry & wife – partnership example

If the bank decides that IR35 applies to the engagement, they will deduct PAYE and NIC from the partnership’s fees, as if they were employing Larry.

Self-assessment

If the engager has turnover less than £10.2 million, then Fred Ltd will have to self-assess for IR35, if IR35 applies to the engagement.

Detailed considerations – don’t get caught out

- For the purpose of the off-payroll legislation, the conditions are reviewed in reference to the financial period ending in the previous tax year, i.e. in most cases the set of accounts ending in the previous fiscal year.

- For companies, joint ventures and LLP’s they will be looking at the period ended prior to 6 April 2020 to establish whether the rules apply for the 2020/21 tax year.

- The HMRC responses document which was published in July confirmed that where a company stops becoming small, the rules will apply from the start of the tax year following the filing date at which it ceases to be small.

- If a company has a year end of say 31 December 2019 (it has stopped being small in this year), the filing date will be 1 October 2020. The off payroll rules would therefore apply from 6 April 2021.

- For engagers who are individuals and partnerships, HMRC advised within their responses that unincorporated businesses need to consider turnover for a calendar year rather than their actual accounting period. Where the turnover exceeds £10.2 million in a calendar year they will need to apply the off-payroll working rules from the following tax year.

- This means individuals or partnerships that pass the size threshold would need to keep calendar year records, as well as the records for their actual year end!

- It should also be noted that for large individual and partnership engagers, it is just a turnover test of £10.2 million. The balance sheet and employees tests are not applicable to them.

Subsidiaries

Any business identified as small using the above guidance will still be required to assess if it is the subsidiary of a large or medium-sized parent.

However, if the ultimate parent company is not small under the above individual business definition, then all of its subsidiaries will not qualify as small. Additionally, where the parent company is small, but using the aggregated group accounts for the previous financial year the group exceeds the small threshold the parent will be considered not small for these purposes, and all group members will be subject to the off-payroll legislation.

The aggregate rules apply where two or more of the following qualifying conditions are met;

- Aggregate turnover – not more than £10.2 million net (or £12.2 million gross).

- Aggregate balance sheet total – not more than £5.1 million net (or £6.1 million gross).

- Aggregate number of employees – not more than 50.

Subsidiary example 1:

A Ltd trades in the selling of furniture and the last set of accounts showed the following results.

| Turnover | £4 million |

| Balance Sheet | £3 million |

| Average employees | 10 |

Based on these results, the company is treated as small and is not caught by the off-payroll working rules.

Subsidiary example 2:

After a few years A Ltd develops another trade through a subsidiary company, B Ltd, to sell office furniture.

The company results are as follows:

| A Limited | B Limited | Aggregate | |

| Turnover | £4 million | £5 million | £9 million |

| Balance Sheet | £3 million | £3 million | £6 million |

| Average employees | 15 employees | 15 employees | 30 employees |

The off-payroll working rules do not apply in the above example.

When aggregated the accounts show that the balance sheet total exceeds the threshold limit of £5.1 million so they have met one of the conditions. However, as they have not exceeded the turnover or employee test they are not caught by the off-payroll working rules, as they must meet two of the conditions.The off-payroll working rules do not apply in the above example.

Subsidiary example 3:

A few more years pass and another trade is introduced into a further new subsidiary, C Ltd, selling garden furniture. The company results are as follows

| A Limited | B Limited | C Limited | Aggregate | |

| Turnover | £4 million | £5 million | £2 million | £11 million |

| Balance sheet | £3 million | £3 million | £1 million | £7 million |

| Average employees | 15 employees | 15 employees | 5 employees | 45 employees |

When looking at each company in isolation all of them are treated as small. However, when the accounts are aggregated they exceed the limits for the turnover and balance sheet tests and are therefore not small under the Companies Act definition.

As a result, the off-payroll working rules will apply.

Operating the off-payroll working rules

Where the individual works for a medium or large-sized engager that operates in the private sector through their own Personal Service Company (PSC), the engager will be required to operate the off-payroll working rules.

The end client will be required to review the arrangement with the individual worker to determine whether the status is one of employment or self-employment.

Where status is to be treated as an employment, the payment is treated as a deemed salary payment and will be subject to tax and national insurance. This is paid by the fee payer, who is the last person in the contractual chain before the PSC. The fee payer is also responsible and liable for the payment of the Class 1 secondary contributions (employer contributions).

It will be most common for the end-client and the fee payer to be one and the same.

The end-client will be required to provide a status determination to the worker advising of their decision, although this will be subject to the new client-led disagreement process (mentioned below) which allows the worker to challenge a decision if they feel that it is incorrect.

Agency arrangements

Where there are agencies between the end-client and the PSC, the end-client is also required to pass the status determination down the contractual chain to the next business in the chain and this should follow down to the final business who will be paying the PSC.

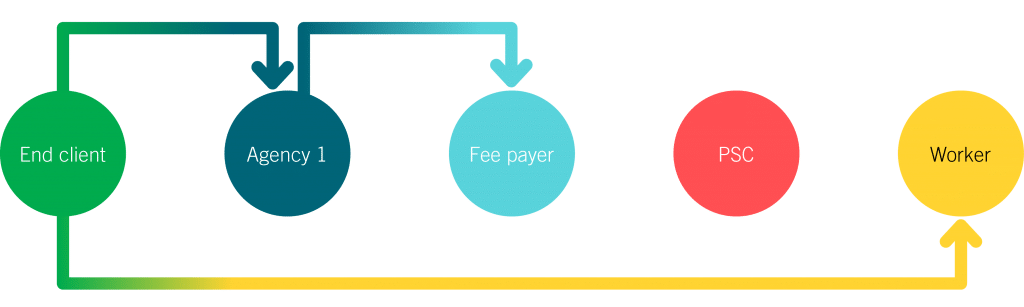

Agency example 1:

In the example above, the end client would be required to pass the decision directly to the worker and also to agency 1. The agency will then be required to pass the decision to the next business in the contractual chain, which is the fee payer. The fee payer will then operate PAYE and NIC on the payment to the PSC.

Where there is non-compliance with the new rules, the PAYE and NIC liabilities will initially lie with the business that failed to meet its obligations.

Using the above example, everyone in the supply chain has been provided with the status determination but the fee payer does not actually make the payment through the payroll. As they have failed to meet their obligations, the liability for non-compliance will lie with them.

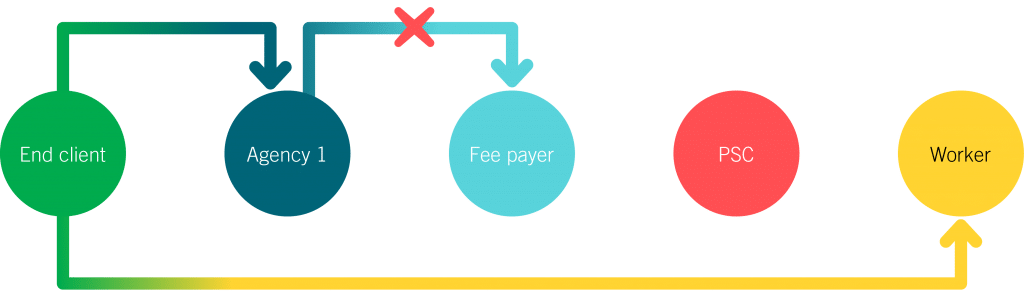

Agency example 2:

In this example, the end client has provided the status determination to the worker and agency 1. However, agency 1 did not provide the status determination to the fee payer. As it was agency 1 that failed to meet its obligations, the liability will instead lie with them and not the fee payer.

HMRC has also confirmed that there will be a transfer of liability provision. This means that if the fee payer could not pay the liability, then it would instead transfer back to agency 1 to pay.

If HMRC is unable to collect the liability from agency 1 then it will transfer back to the end-client.

This is intended to ensure that the end-client can identify their contractual chain and would undertake due diligence to check that they are working with reputable agencies.

HMRC has advised that further guidance will be provided to explain the circumstances in which it will not seek unpaid liabilities from further up the supply chain.

Client-led disagreement process

There is now a formal ‘disagreement process’, where the worker wants to challenge the application of IR35.

There is no time limit for the challenge itself but you would assume that the challenge will be almost instant, as the worker would be advised of their status determination by the client, and would then be paid net, through the payroll, unless a challenge was made.

It is also important to note that this ‘client led disagreement process’ is now also applicable to the public sector as well.

The new disagreement process provides for a 45 day period, beginning with the day the challenge is made, where the client must either:

- inform the worker and the deemed employer that they believe, after consideration, that the conclusion is correct, or

- give the worker and the deemed employer a new status determination statement (SDS), withdrawing the first one.

The client must also give the reasoning for deciding that the conclusion is correct after it has been challenged.

Where a new SDS is provided it is treated as having been given to the fee payer by the person immediately above them in the chain. However, the end-client will take the place of the fee payer in the event that the client fails to:

- comply with the 45 day rule; or

- inform the worker or deemed employer that they believe, after consideration, that the conclusion is correct, or

- give the worker and the deemed employer a new status determination statement (SDS), withdrawing the first one, or

- fails to provide the reasoning.

So, the liability to deduct the payments for tax are effectively transferred from the fee-payer to the client if the client defaults under the disagreement process. This is a critical point because the client could very easily find themselves liable for the PAYE and NIC for an admin error.

This is intended to remove the uncertainty where a worker previously did not agree with the decision in the public sector but had no way of challenging the decision other than by completing an incorrect tax return and not including the income paid through the payroll, effectively inviting an enquiry into their tax affairs.

Payments through the payroll

The fee payer will be required to include the worker on their payroll and deduct PAYE and NIC from the payment.

This will require the fee payer to get the worker to complete new starter forms as though they are a new employee for the business.

This will then determine the correct tax code that should be used.

The fee payer will also have to pay Class 1 secondary NIC on the payment which could result in the fee payer encountering financial difficulty if they only have a small margin on the payment.

At the end of the tax year the fee-payer will then issue the worker with a P60 confirming the payments that have been made in the year. If the work is only for a short period and the fee-payer knows there will be no further work in the tax year, then they would issue a P45.

The worker would then complete their personal tax return and include the details from the P60/P45 that they were given.

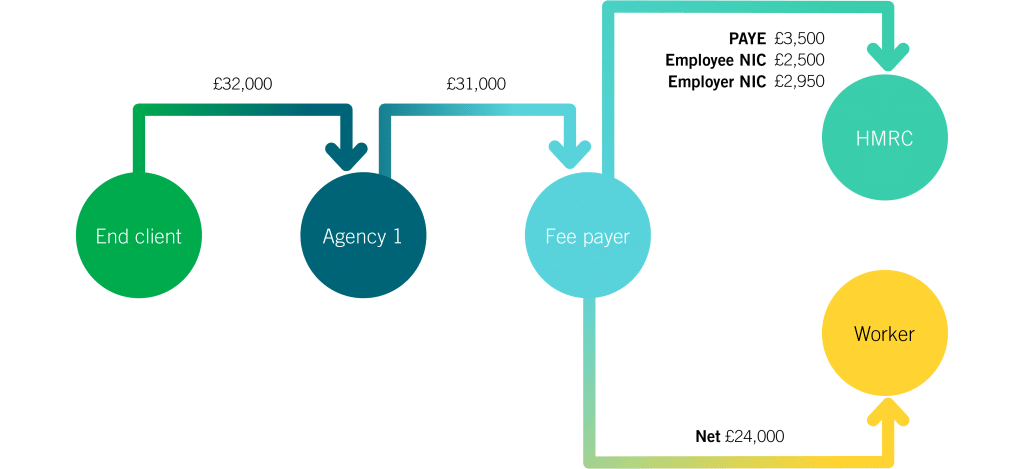

Agency example 3

The PSC agrees to a contract worth £30,000. The fee payer charges agency 1 £31,000 for this work which includes their ‘profit’ on the engagement of £1,000.

Agency 1 then has an agreement with the end-client for £32,000 which includes a ‘profit’ of £1,000 on their cost.

The end-client pays the £32,000 to the agency who takes their cut and pays £31,000 to the fee payer.

When the fee payer comes to pay the PSC it needs to deduct PAYE and NIC from the payment of £30,000 but also pay Employers NIC on the payment.

It pays a net payment to the PSC of £24,000 and the PAYE of £3,500 and the Employee NIC of £2,500 to HMRC. This comes to the £30,000 which the fee payer received.

However the fee-payer also has to pay Employers NIC on the payment which comes to £2,950. The overall cost to the fee payer is £32,950 but they have only received £31,000 so they have now made a loss of £1,950.

It is likely that the fee-payer will need to consider whether to renegotiate the agreements with either the PSC, end-client or both otherwise it is unlikely their business will be able to continue.

Corporation tax arrangements

Barney is an IT consultant. He works through his company Rubble Ltd.

Rubble Ltd billed the client £160,000.

The client, Bedrock Corporation, reviewed the contract and determined that it was within the off-payroll rules and advised him that he was caught.

Barney disagreed and appealed under the client-led appeal process. The client then had 45 days to review the position and advise of any amendment.

After 30 days the client finished their review and confirmed that in their view he was caught by the off-payroll rules.

The client therefore paid his company’s fees through the payroll.

As Barney already has an employment with Rubble Ltd, the client was advised to use a BR tax code so they deducted PAYE at 20% i.e. £32,000 and NIC of £7,000 (for this example). The net payment of £121,000 is referred to as a deemed direct payment.

The turnover figure for accounts should be the net amount received by the company (£121,000)

The company makes up its accounts for the year ended 31 March 2021.

The accounts show:

| £ | £ | |

| Income | 121,000 | |

| Less | ||

| General administrative company costs | 2,000 | |

| Accountancy fees | 1,500 | |

| Company filing and other expenses | 800 | |

| Postage and stationery | 1,400 | |

| Computer expenses | 2,000 | |

| Sundry expenses | 1,800 | |

| (9,500) | ||

| Net profit | 111,500 |

When preparing the tax calculation, a CT deduction is allowed for the deemed salary payment under s139 CTA 2009 which states that “this section applies for the purpose of calculating the profits of a trade carried on by an intermediary which is treated as making a deemed employment payment in connection with the trade.”

The company’s taxable profit would be:

| £ | £ | |

| Income | 121,000 | |

| Less | 121,000 | |

| Less deemed direct payment | 2,000 | |

| General administrative company costs | 1,500 | |

| Company filling and other expenses | 800 | |

| Postage and stationery | 1,400 | |

| Computer expenses | 2,000 | |

| Sundry expenses | 1,800 | |

| (130,500) | ||

| Net taxable loss | (9,500) |

The loss created by deducting the deemed payment would be carried forward to be used against future trading profits, investment income and capital gains, should they arise.

Corporation tax trading losses

Since the 1960s, a company with a trading loss, to carry forward, could only carry it forward and set it against profits from exactly the same trade and nothing else.

However, for company trading losses incurred in an accounting period beginning on or after 1st April 2017, everything has changed.

The trading loss can be carried forward against the first £5 million of its total chargeable profits (including investment income and capital gains) and also against 50% of the company’s chargeable profits that exceed £5 million.

Extra point:

It should also be noted that when you carry forward an ‘old style trading loss’(i.e. a trading loss incurred pre 1st April 2017), beyond 1st April 2017, the Finance Act states that this ‘old style loss’ carried forward is also subject to the £5 million and 50% cap!

General Example:

X Ltd year ending 31 December 2019

Trading loss (£10 million) to be carried forward

X Ltd year ending 31 December 2020

Trading profit £7 million

Investment income £4 million

Total profits £11 million

Question: What is the maximum loss set off in 2020?

Answer: £11 – £5 = £6 excess, £6 @ 50% = 3, £5 + £3 = £8

Accordingly, the maximum loss set off for the year ended 31st December 2020 is (£8 million).

Further comments re the carry forward of company trading losses

- The company must continue to trade in the following accounting period to which the loss has been carried forward to.

- The company’s trade must not have become small or negligible in the loss making accounting period.

- The company’s trade must be commercial in both the actual loss making period and the period for which relief is claimed.

- The losses of the company must not arise from a trade carried on wholly outside the UK for the loss making period.

How to extract the funds from the personal service company?

Homer Ltd is owned 80% by Homer and 20% by his wife, Marge.

Homer Ltd invoices £100,000 (ignoring the VAT). His client deducts a total deduction of, say, £32,000 being tax and national insurance. Accordingly, the net sum paid by the client to Homer Ltd is £68,000.

Homer Ltd has now received the net figure of £68,000 from the client, and Homer wants to extract the £68,000

Extraction of Funds by salary

It is possible to take the income as remuneration. The worker is able to set-off an amount of the deemed direct payment before any liability to PAYE/NIC arises on that remuneration.

Example 1:

Homer decides to take the full amount of the deemed direct payment of £68,000 as remuneration in the year.

The position would be as follows:

Salary payment | £68,000 |

Less deemed direct payment | (£68,000) |

Subject to PAYE/NIC | £0 |

An RTI submission would be made for the payment with no tax or national insurance to be paid. This would be reported as a non-taxable payment on the FPS that the payroll software produces.

Where the Basic PAYE tools are used the payments do not need to be included per HMRC’s own guidance.

Example 2:

Homer has other income within the company which is outside the off-payroll working rules and decides to pay himself £80,000 as remuneration.

The position would be as follows:

Salary payment | £80,000 |

Less deemed direct payment | (£68,000) |

Subject to PAYE/NIC | £12,000 |

The amount of £12,000 would be subject to PAYE and NIC and reported through the payroll of the PSC.

Tax would be calculated based on the tax code in operation with the PSC and Class 1 national insurance would be payable by Homer and the company on this amount only.

Extraction of Funds by dividend

The funds could be paid by a dividend from the company’s profits. Like the payment of remuneration the dividend payment is tax-free up to the total of the deemed direct payment.

Homer would not need to include the dividend on his self assessment tax return so long as it does not exceed the deemed direct payment.

However, as Homer Ltd has another shareholder, Marge, she would also be entitled to a dividend payment.

Example:

Homer Ltd declares a dividend of £68,000, being £54,400 to Homer and £13,600 to Marge.

Homer’s payment would be covered by the deemed direct payment and no further liability would arise. He would not need to include the dividend on her tax return.

As the deemed direct payment relates to income earned by Homer as a deemed employee the deemed direct payment would only apply to payments received by him. (ITEPA2003 s61W)

Marge would be required to pay tax on her dividend and this would be reported through her self assessment tax returns.

This creates a double tax charge on this share of the income and there would be an unused amount of the deemed direct payment for the year.

This would not be advisable.

Is it possible to avoid double taxation?

The company could create a new class of share which is owned by Homer only. He could then be paid a dividend equivalent to the deemed direct payment before Marge is paid on the other class of shares.

This route would require consideration in other tax areas as well and could be caught by settlements legislation.

Alternatively the husband and son could waive their shares but this could lead to issues where the company does not have sufficient distributable profits to cover the dividend paid and the dividend waived.

In practice, the simplest way to avoid double taxation where there is a deemed payment attributable to only one shareholder is to pay remuneration to that shareholder equal to the deemed payment.

Overseas aspects

Overseas Parent Company

The HMRC guidance so far has been relatively quiet on the overseas aspects of the off-payroll working rules. However, it is assumed that overseas companies would follow the rules of those in the UK.

Slate Group Ltd has an Australian holding company and four UK subsidiaries.

The offshore holding company has turnover of £60 million, and £20 million of assets, and 200 employees.

Each UK subsidiary company meet the small company exemption on their own (so turnover of less than £10.2 million, asset of less than £5.2 million and less than 50 employees)

However, as they are a group it is necessary to consider the conditions in relation to them all as though they are the one entity. Due to the size of the holding company they would all be required to operate the off-payroll working rules on contracts with their subcontractors.

Working for an overseas client

Where the contract is within the off-payroll working rules it is necessary to consider the normal payroll rules to determine who is required to operate the payroll.

Example:

Fred Ltd is a UK company and engages to work for an overseas client, Slate Ltd, who are based in Australia.

Slate Ltd are required to operate the off-payroll rules which means that they should include the payment on the payroll.

However, as they have no presence in the UK it would instead fall on Fred Ltd to operate the payroll on their behalf.

Duties of worker performed outside UK

Question:

- we use a Spanish individual to deliver our technical services provision all over the world

- he invoices us from his Spanish company, however he is also a ‘one man band’ company

Would IR35 apply to his company?

Answer:

IR35 only applies where you have an individual performing UK employment duties (whether UK resident or non-UK resident but working here). If this person’s role is wholly outside of the UK then IR35 would not apply.

What can we learn from the IR35 tribunals? Read up on the latest wins and losses in court.

Meet the author

Tim Palmer is one of the UK’s most prolific and popular tax lecturers.